Author: Nalene de Klerk | January 2024 |

With an ever-sharpening public focus on corporate transparency and accountability, the past three years have seen a significant shift in the integrated, sustainability and ESG reporting landscape in terms of frameworks and standards.

The IFRS Sustainability Disclosure Standards (S1 and S2), issued in June 2023 by the International Sustainability Standards Board (ISSB), “ushered in a new era of sustainability-related financial disclosures in capital markets worldwide,” according to the IFRS Foundation.

But what exactly are these disclosure standards, how do they differ from existing frameworks, and what implications do they have for your organisation? These are some of the topics we cover in this article.

What is the purpose of these disclosure standards?

The primary focus of the S1 and S2 disclosures is to shed light on sustainability-related risks and opportunities that significantly influence an organisation’s financial health. They are specifically geared towards meeting investor information needs, accompanying the financial statements in the annual report. In the words of the ISSB, such reporting should contain:

| “All sustainability-related risks and opportunities that could reasonably be expected to affect a company’s prospects – its cashflows, access to finance or cost of capital over the short, medium and long term.” |

The disclosures are based on the work of the Task Force on Climate-Related Financial Disclosures (TCFD). In fact, the TCFD sees the publication of the standards as the culmination of its work and transferred its responsibilities to the ISSB from 2024.

At this point, it is also important to understand that the purpose of the IFRS Sustainability Disclosure Standards is not to showcase a company’s impacts on its environment and society – there are other reporting frameworks for that.

Where do these standards fit in the ecosystem of sustainability reporting frameworks and standards?

To understand how the ISSB sustainability disclosure standards fit into the alphabet soup of a sustainability reporting guidance universe, it is critical to understand what “materiality” means.

For those who are not well-versed in accounting concepts: material issues, according to the IFRS Foundation, include anything that “could reasonably be expected to affect investor decisions.” Simply put, the matters that impact the organisation’s financial performance – now and in the future.

On the other hand, the Global Reporting Initiative (GRI) – one of the most commonly-used sustainability standards in the world – defines material topics differently. These are the topics that “represent an organization’s most significant impacts on the economy, environment and people, including impacts on human rights.”

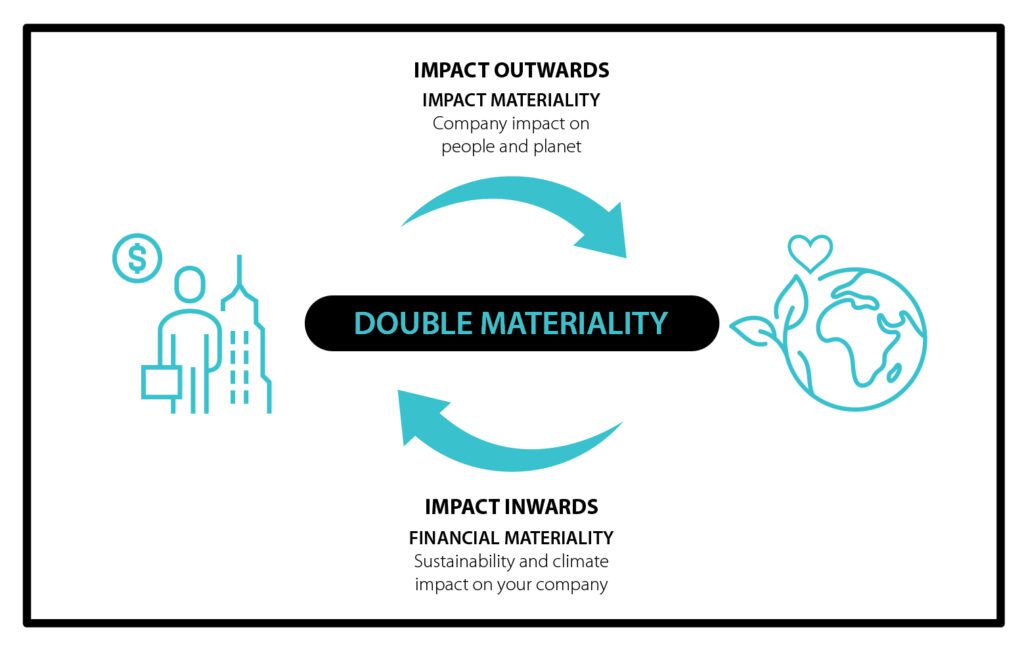

This brings us to the concept of “double materiality,” where organisations are expected to report not only on how external factors impact them but also on their own impact on the wider world.

For the purpose of the ISSB’s Sustainability Financial Disclosures, your organisation needs to report on material external factors that impact your organisation’s financial performance.

What does this mean if your organisation has used other frameworks and standards until now? Well, the IFRS Sustainability Disclosure Standards are not meant to replace or compete with existing sustainability reporting frameworks and standards. Rather, it aims to complement and build on these frameworks and standards by providing a common and consistent foundation for sustainability-related financial disclosures. We cover some of the other frameworks and standards in play currently.

GRI

The GRI standards complement the ISSB standards by providing the other leg of “double materiality.” GRI and the IFRS Foundation have signed a memorandum of understanding (MoU), committing to work together to ensure that their standards complement each other.

Disclosures against the GRI standards are often published in a sustainability or ESG report, separately from the financial report. This report is intended for a broader group of stakeholders than just investors and explains how the organisation impacts on the world around it. Other companies combine the annual report and sustainability disclosures in an integrated reporting suite. Your company’s approach depends on its unique reporting history, available data, and audience.

The International <IR> Framework

The International <IR> Framework is the framework that guides integrated reporting globally. It promotes the publication of an integrated report that provides a concise communication of how an organisation creates value over time by integrating financial and non-financial information. The Framework was initially developed by the International Integrated Reporting Council (IIRC), which has since been absorbed into the IFRS Foundation as part of the ISSB. The ISSB is now custodian of this Framework, as it is of the S1 and S2 standards.

The <IR> Framework is compatible and complementary with the IFRS Sustainability Disclosure Standards, as they share the same objective of providing relevant and reliable information to investors and other capital market participants. The Framework can be used to provide a broader context and connectivity for the sustainability-related financial disclosures required by the IFRS Sustainability Disclosure Standards.

Therefore, if your organisation has been using the International <IR> Framework to compile its reports, it can continue to do so, as long as it also complies with the IFRS Sustainability Disclosure Standards.

The Sustainability Accounting Standards Board (SASB) standards

SASB was incorporated into the IFRS Foundation alongside the IIRC. However, while the <IR> Framework is industry-agnostic, the SASB standards are industry-specific, covering 77 different industries as at November 2023.

The IFRS Sustainability Disclosure Guidance specifically states that an organisation wishing to comply with S1 and S2 must find and report against its industry’s specific SASB standard(s). Although these standards were initially geared for report preparers in mainly the United States – including some region-specific disclosures that were not necessarily relevant to those outside North America – reporting against the SASB standards recently became much easier. Amendments published in December 2023 revised the SASB standards to make them more jurisdictionally-agnostic.

In summary…

The standards above are not exhaustive. You might refer to the European Sustainability Reporting Standards (ESRS) – or, indeed, other regional frameworks such as the JSE Sustainability Disclosure Guidance in South Africa – as well as the United Nations Sustainable Development Goals (UNSDGs) and the information requirements of the CDP, MSCI, and other ratings agencies.

The IFRS Sustainability Disclosure Standards promote a “building blocks” approach through a core set of disclosures that are relevant for investors and capital markets. Reporters build on these by accessing other frameworks and standards for additional disclosures that are relevant to their specific stakeholders, or to report on specific sectors or regions. The important thing is that the information your company reports fits the needs of your particular stakeholders, while adhering to principles of transparency.

Are the standards compulsory?

The ISSB is not a regulatory body and cannot prescribe that companies adopt its standards. The IFRS Sustainability Disclosure Standards are therefore not mandatory, though they could become so in forthcoming years.

However, they are designed to be widely adopted by jurisdictions that want to improve the quality and consistency of sustainability-related financial disclosures.

In July 2023, these standards were endorsed by the International Organization of Securities Commissions (IOSCO), which represents the world’s securities regulators and sets global standards for capital markets. IOSCO has also encouraged its members to consider the use of these standards for issuers under their jurisdictions. Why is this noteworthy? Because IOSCO’s 130 member jurisdictions regulate over 95% of the world’s financial markets.

Therefore, depending on where your company operates and what regulations apply to you, you may be required or encouraged to adopt the IFRS Sustainability Disclosure Standards soon.

When do they come into effect?

IFRS S1 and IFRS S2 are effective for annual reporting periods beginning on or after 1 January 2024.

While most jurisdictions and regulators may not have mandated reporting against these standards by this date, companies are advised to make an early start. Let’s have a brief look at the topics covered in the S1 and S2 standards.

S1 and S2: A brief overview

Before you start implementing S1 and S2 in your reporting, a note on report publishing timelines: Since the sustainability disclosures are meant to support an organisation’s financial reporting, it follows that these disclosures be published at the same time as your annual financial statements. The disclosures should also be prepared for the same entity and reporting period as the financials and align with the financial statements in terms of data and assumptions.

Then, the IFRS Sustainability Disclosure Standards require that you check the SASB standards to see which one(s) relate to your industry most closely, with these disclosures included in your reporting. In addition, a company may consider the CDSB Framework Application Guidance, industry best practice, and materials of investor-focused standard setters when deciding which risks and opportunities are material to report. For matters other than climate-related information, a company can also consider the GRI and the ESRS, for example.

S1: General requirements for disclosure of sustainability-related financial information

As the title says, the S1 standard provides for general disclosures about an organisation’s approach to sustainability.

These are divided into the following subject areas, as contained in the S1 guidance, with lists of disclosures that a company is expected to report on:

-

- Governance: While many companies today have extensive corporate governance reporting processes in place, S1 focuses specifically on sustainability-related risks and opportunities. How are these considered and tracked at the highest levels of management within the organisation?

-

- Strategy: How does your organisation manage its sustainability risks and opportunities? The corporate strategy may play a role here, and sustainability should optimally be embedded within the organisation’s overall strategy, but S1 speaks to sustainability specifically.

-

- Risk management: Again, many companies are adept at disclosing their corporate risk management processes, but how are sustainability risks considered as part of the process? Has your organisation considered the impact of climate change on its future operations, for example?

-

- Metrics and targets: How is your organisation performing in terms of its sustainability risks and opportunities? Have you set targets, and how are you performing against them?

Ultimately, the organisation’s reporting should showcase how it is actively thinking about, tracking, and performing in terms of sustainability risks and opportunities.

S2: Climate-related disclosures

The S2 standards follow similar themes to S1 in terms of disclosing Governance, Strategy, Risk Management, and Metrics and Targets – but specifically in terms of climate change.

The Metrics and Targets section deserves special attention, though. It requires the organisation to disclose its:

-

- greenhouse gas emissions (including Scope 1, 2 and 3) and how these are tracked and calculated.

-

- climate-related transition risks (the quantified impact as the organisation adapts to climate change through, for example, transitioning to renewable energy).

-

- climate-related physical risks (what the quantified impact will of climate change, such as changing weather patterns, on the organisation).

-

- climate-related opportunities.

-

- capital deployment (how much the organisation spends or invests in terms of climate-related risks and opportunities).

-

- internal carbon prices.

-

- remuneration (whether climate-related matters are factored into management remuneration and how this is done).

Many of these disclosures are meant to urge organisations further along the sustainability journey.

If this seems like a lot, here are some reliefs to make it easier

If you feel overwhelmed by the prospect of complying with the IFRS Sustainability Disclosure Standards, you are not alone. Many companies are facing the same challenge of collecting, analysing, and reporting on sustainability-related financial information. The ISSB assumes that enough organisations have become familiar with the TCFD and other standards over the past few years and should therefore be able to report on the ISSB standards relatively easily.

However, the ISSB offers several reliefs in an organisation’s first year of application. Here are some of them:

-

- You can extend the deadline of your sustainability disclosures by approximately six months, to publish them with your half-year results.

-

- Organisations do not need to report on Scope 3, yet – only Scope 1 and 2. However, given the amount of work required to accurately report on Scope 3 emissions, we recommend you get started as soon as possible.

-

- You do not need to use the GHG emissions reporting framework if you already use something else.

-

- You can choose to report only on climate-related information for now, in accordance with S2, while biodiversity and other environmental issues come in later.

-

- You do not need to provide comparative information for previous years, since this is the first year of reporting. This also means that if you are only including climate-related risks in your first year, any further information you report around waste and other matters will not require comparative information in your second year of reporting.

Organisations are also allowed to leverage the existing sustainability reporting frameworks and standards that they are already using, as long as these are aligned and consistent with the IFRS Sustainability Disclosure Standards. Furthermore, you can use the guidance and resources provided by these organisations to help you with the data collection and reporting process.

Next steps:

In summary, the IFRS Sustainability Disclosure Standards guide how organisations report on sustainability risks and opportunities to their investors. While these are not yet compulsory in most markets, it is likely that regulators in many of the world’s top capital markets will require organisations to report against S1 and S2 soon. It is therefore best to start working on collecting and reporting the necessary data as soon as possible – especially given the complexity of the reporting landscape. Ultimately, how and when your organisation reports against S1 and S2 depends on your unique audience and your reporting history.

Need someone to help you tell your unique story in compliance with S1 and S2? The Corporate Reporters, with our rich experience since 1996 in sustainability reporting, is fully equipped to guide you through these new standards. For comprehensive support from our award-winning team, reach out to us at clive@corporatereporters.com.